The Ultimate Guide to Writing a Business Plan

In an age defined by relentless haste, it is easy to fall into the trap of expecting instant results. We often gaze at a simple egg and expect it to hatch into a magnificent bird overnight. However, in the business world, true transformation requires patience, dedication, and a solid roadmap.

Whether you are a tradie looking to expand, a tech startup in Surry Hills, or a retail outlet in Melbourne, understanding the mechanics of a business plan is your first step toward success. This guide will walk you through the essentials of crafting a plan that satisfies lenders, attracts investors, and keeps your vision on track.

Why You Need a Plan (Overcoming Inertia)

The hardest part of writing a business plan isn't the maths or the market research—it’s overcome inertia. It is the laws of physics applied to entrepreneurship: a body at rest tends to stay at rest, usually on a comfortable couch with a binge-worthy show.

To build a successful enterprise, you must kick that inertia. A plan helps you balance urgency with thoughtful preparation. It moves you from a vague idea to a concrete strategy.

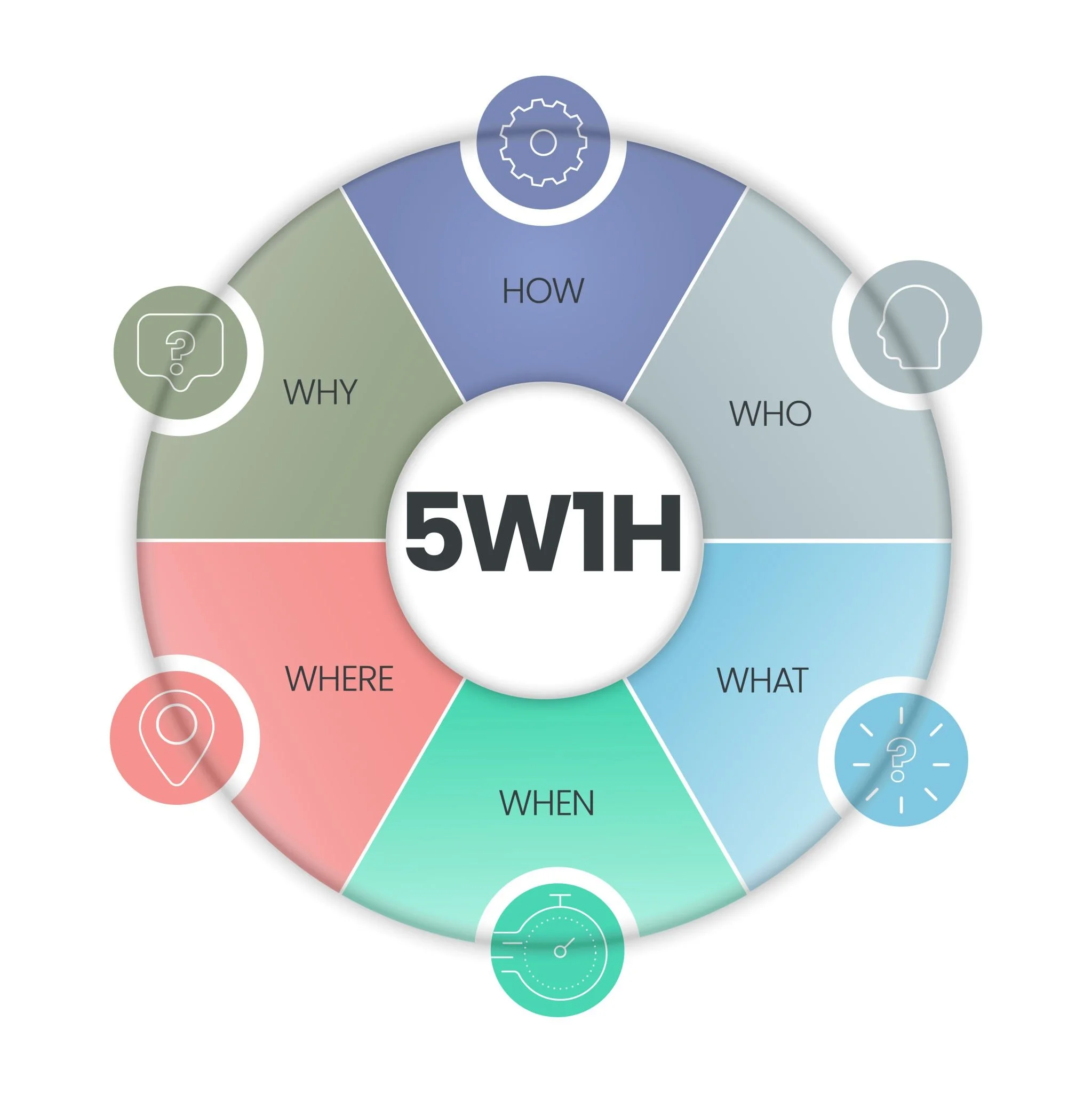

The 5 W’s and the H of Planning

An effective business plan acts as a compass. To ensure your compass is pointing true north, you must address the fundamental interrogatives:

Who: Identify your key players. Who are the owners, advisors, and key personnel? Who is your competition? Most importantly, who is your customer?

What: Define your unique value proposition. What problem are you solving? What product or service are you offering, and what sustainable advantage do you hold over the market?

When: Outline your timeline. When will you launch? When do you expect to hit revenue milestones?

Where: Location is critical. Will you be a physical shopfront, an online store, or a hybrid? Where is your target demographic located?

Why: This is your motivation. Why does the market need this solution? Why would a customer choose you over a competitor?

How: This is your operational roadmap. How will you transition from your current position to your goals? This covers marketing, sales processes, and financial pathways.

Structuring Your Business Plan

While every plan is unique, a standard Australian business plan should generally follow this structure to ensure clarity for banks and investors:

Executive Summary: Your "calling card." It must be captivating, outlining your mission and financial snapshot.

Company Overview: Legal structure (e.g., Sole Trader, Pty Ltd), history, and location.

The Team: Investors bet on the jockey, not just the horse. Highlight the experience and track record of your management team.

Market Analysis: Prove you understand your demographic and competitors.

Operational Strategy: How the business functions day-to-day.

Financials: The heartbeat of the plan.

The Financials: The "Make or Break" Section

Novice entrepreneurs often underestimate costs and overestimate revenue. Avoid the trap of realising mid-launch that you need $300,000 when you only budgeted for $150,000.

Your financial section must be grounded in reality, not hopeful speculation. It should include:

Cash Flow Statement: Tracking the movement of money in and out.

Income Statement: Revenue vs. expenses.

Balance Sheet: A snapshot of your financial standing.

Break-Even Analysis: When will the business become profitable?

Tip: If numbers aren't your strong suit, hire a financial advisor. A lack of understanding here can destroy your credibility with investors.

Tailoring for the Audience: Investors vs. Lenders

Not all money is the same. A bank (debt funder) has different priorities than a venture capitalist (equity funder).

Lenders (Banks): They want security. They focus on your ability to repay the loan (cash flow) and the collateral you offer. They are risk-averse.

Investors (Equity): They want growth. They look for a scalable market, a unique product, and an exit strategy. They are willing to take risks for high returns.

Case Study: Bob the Plumber

Consider "Bob," a plumbing business owner (a scenario that plays out across Australian suburbs daily). Bob had a solid business but hit a ceiling. He wanted to bid on large government infrastructure contracts but lacked the strategic foresight.

Bob hired consultants who identified a key weakness: his bonding limit (insurance) was too low. He was bonded for $100,000, which limited his bids to $1 million. To grow, he needed a $1 million bond.

Bob went to the bank to finance this increase. Because he presented a detailed business plan showing exactly how the increased bonding would generate higher cash flow through government tenders, the bank approved him. The plan turned a "no" into a "yes," allowing Bob to scale his business significantly.

The Rich Dad 'B-I Triangle' Framework

For those following the Rich Dad philosophy, consider structuring your thinking around the B-I (Business Owner-Investor) Triangle.

This framework emphasises that a business is a system of systems. It relies on a strong Mission, Team, and Leadership at the core, supported by Cash Flow, Communications, Systems, Legal, and Product management. Focusing too much on the product and ignoring the legal or cash flow systems is a recipe for failure.

Final Thoughts

A business plan is not a static document to be shoved in a drawer; it is a living, organic roadmap. It evolves as your market changes—whether that's a shift in the Australian economy, new competitors, or changing consumer habits.

Don't wait for the perfect moment. Grab a notebook, fight the inertia, and start sketching your future today.